Which Is Better: ICO, STO, or IEO for Crypto Projects?

Here’s What’s Inside This Blog Post1 What is an ICO (Initial Coin Offering)?2 What is an STO (Security Token

Here’s What’s Inside This Blog Post

As the blockchain industry continues to evolve, so do the methods by which crypto startups raise capital. Among the most popular fundraising mechanisms are Initial Coin Offerings (ICO), Security Token Offerings (STO), and Initial Exchange Offerings (IEO). Each method has unique advantages, regulatory implications, and strategic value depending on the goals of the project. For investors and developers alike, understanding the key differences between ICOs, STOs, and IEOs is crucial in making informed decisions. So, which is better for launching a crypto project in 2025 and beyond? Let’s break down the facts.

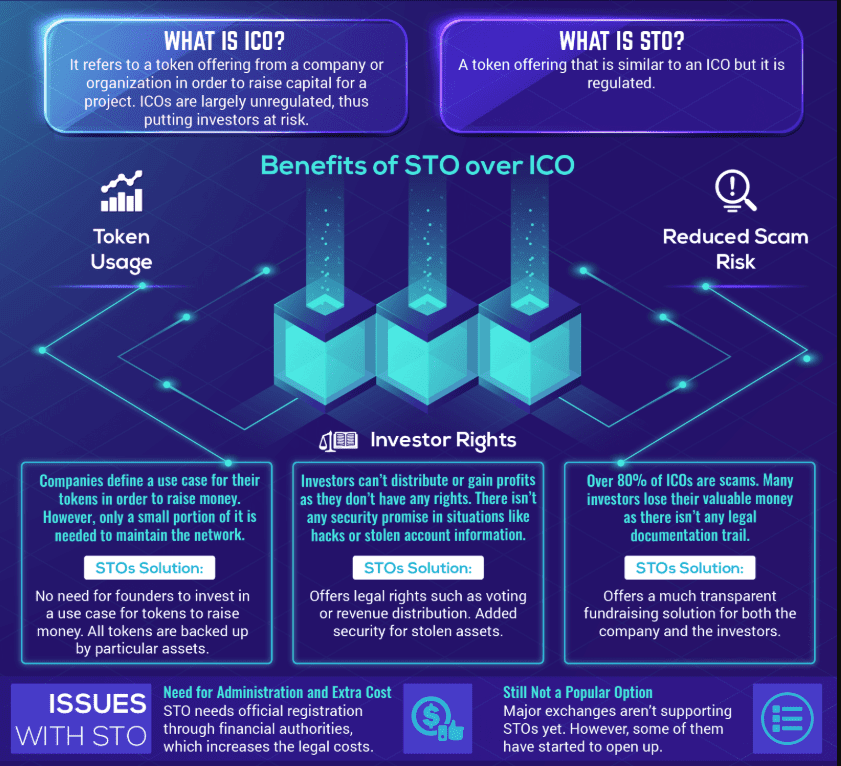

What is an ICO (Initial Coin Offering)?

An Initial Coin Offering (ICO) is a crowdfunding method where blockchain projects sell digital tokens to raise capital, typically in exchange for established cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH). Popularized in 2017, ICOs allow startups to bypass traditional funding channels like venture capital, offering a decentralized and accessible way to raise funds globally. Projects create a whitepaper outlining their vision, technology, and token utility, which investors use to assess potential. ICOs are relatively easy to launch, requiring only a website, a whitepaper, and a technical team. However, their unregulated nature has led to significant risks, with many projects turning out to be scams or failing to deliver, resulting in substantial investor losses.

For example, during the 2017 ICO boom, over $22 billion was raised, but numerous projects collapsed due to lack of oversight. Despite these risks, ICOs remain attractive for early-stage projects seeking low-cost, scalable funding with a focus on community engagement.

Pros of ICOs:

- Full control over fundraising

- Low setup costs

- Global investor participation

- No need for exchange listing at launch

Cons:

- High risk of scams and frauds

- Regulatory uncertainty in many regions

- Lower investor trust due to lack of third-party vetting

While ICOs are ideal for early-stage projects aiming for quick capital without regulatory hurdles, they’ve become less favored due to lack of investor protection and frequent misuse by fraudulent entities.

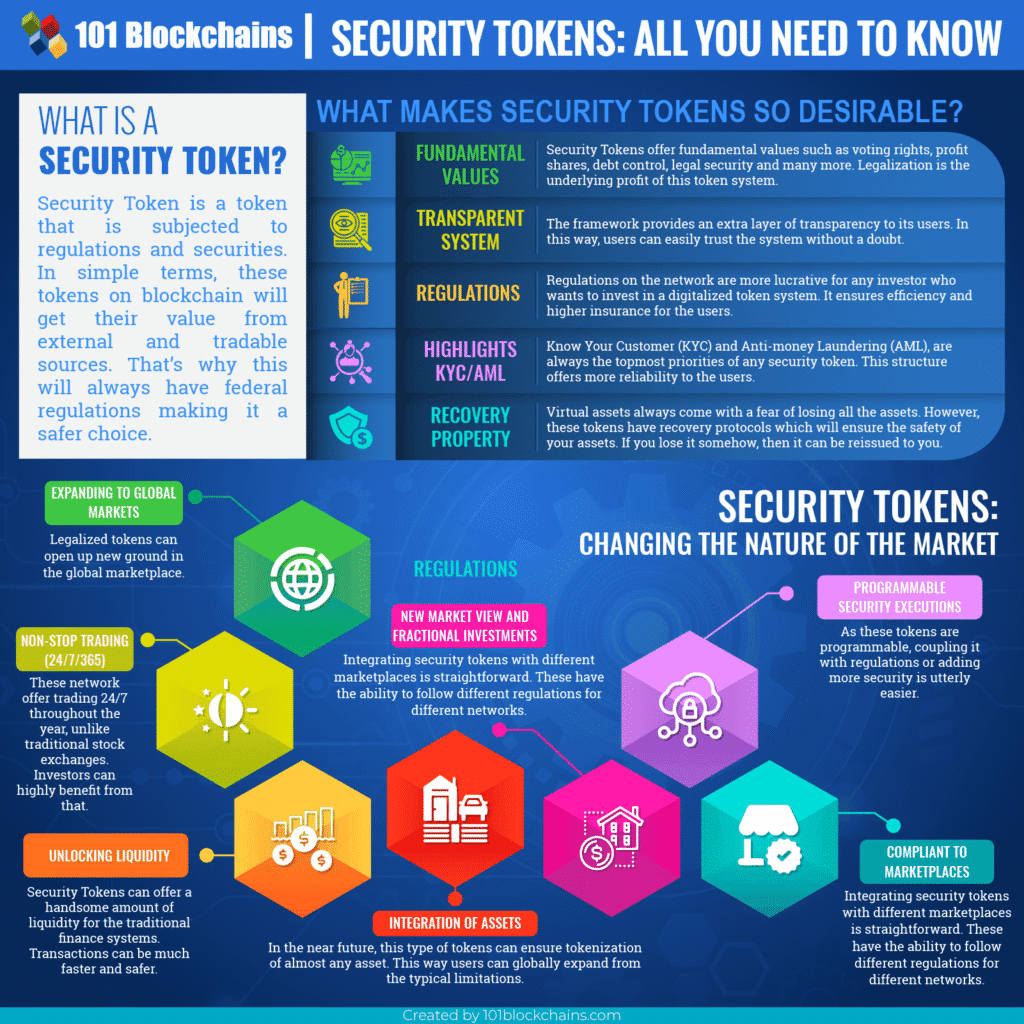

What is an STO (Security Token Offering)?

Security Token Offerings (STOs) are a more regulated alternative to ICOs, involving the sale of tokens classified as securities, backed by real-world assets like equity, real estate, or bonds. STOs adhere to strict regulatory frameworks, such as those set by the U.S. Securities and Exchange Commission (SEC) or the Swiss Financial Market Supervisory Authority (FINMA), ensuring investor protection and transparency. This compliance makes STOs appealing to traditional investors familiar with securities markets. However, the regulatory complexity increases the cost and time required to launch an STO, often limiting participation to accredited investors. STOs offer enhanced security, as tokens represent ownership in tangible assets, reducing the risk of fraud.

In 2018, STOs gained traction in the finance and banking sectors, raising significant funds due to their alignment with traditional financial systems. For projects prioritizing long-term stability and investor trust, STOs are a compelling choice, though their high barriers to entry may deter smaller startups.

Pros of STOs:

- Regulatory compliance builds trust

- Attracts institutional investors

- Represents ownership or tangible assets

- Reduced legal risks for both issuer and investor

Cons:

- Expensive and complex legal procedures

- Limited investor pool due to accreditation requirements

- Longer time to market

STOs are ideal for projects aiming for long-term legitimacy, transparency, and access to traditional capital markets. They’re best suited for serious ventures like tokenized real estate, equity crowdfunding, or institutional blockchain initiatives.

What is an IEO (Initial Exchange Offering)?

Initial Exchange Offerings (IEOs) are a hybrid model where a cryptocurrency exchange facilitates the token sale on behalf of a blockchain project. Unlike ICOs, IEOs involve rigorous due diligence by the exchange, which vets the project’s legitimacy, financials, and team before listing. This process enhances investor confidence, as exchanges like Binance or OKX stake their reputation on the projects they host. IEOs offer immediate liquidity, as tokens are listed for trading shortly after the sale, and leverage the exchange’s user base for marketing. However, exchanges charge significant listing fees, sometimes up to 20 BTC or 10% of funds raised, which can be a drawback for projects with limited budgets.

IEOs balance accessibility and security, making them suitable for projects seeking quick market entry with moderate regulatory oversight. By 2019, IEOs became a popular choice due to their streamlined process and higher trust levels compared to ICOs.

Pros of IEOs:

- Increased credibility through exchange vetting

- Built-in user base and marketing support

- Immediate exchange listing after fundraising

- Enhanced security via KYC/AML checks

Cons:

- Costly listing and marketing fees

- Dependence on exchange terms and timelines

- Limited fundraising flexibility

IEOs are ideal for projects that want instant exposure and liquidity while offloading the burden of compliance and security to a trusted platform. However, they can be expensive, and the project loses some control over the fundraising process.

ICO vs. STO vs. IEO: Which Is Best?

To determine the best fundraising model, it’s essential to compare ICOs, STOs, and IEOs across key factors like regulation, accessibility, cost, trust, and liquidity. ICOs are the least regulated, offering low barriers to entry but high risks of scams and project failure. STOs are heavily regulated, providing investor protection but requiring significant compliance costs and limiting participation to accredited investors.

IEOs strike a middle ground, with exchanges conducting due diligence to enhance trust while maintaining relatively accessible participation for verified users. In terms of cost, ICOs are the cheapest to launch, followed by IEOs, which incur exchange fees, while STOs are the most expensive due to legal requirements. For liquidity, IEOs excel as tokens are listed immediately, whereas ICO and STO tokens may face delays.

Trust levels are highest in STOs, followed by IEOs, with ICOs being the least reliable due to minimal oversight. Each model caters to different project needs, from rapid fundraising to regulatory compliance.

| Criteria | ICO | STO | IEO |

|---|---|---|---|

| Regulation | Low/unclear | High (regulated) | Moderate (exchange compliance) |

| Cost to Launch | Low | High | Medium to High |

| Investor Trust | Low to Moderate | High | Moderate to High |

| Speed to Market | Fast | Slower | Fast |

| Security | Low | High | Moderate to High |

| Ideal For | MVP-stage crypto startups | Asset-backed/tokenized firms | Projects wanting instant listing |

Ultimately, the best fundraising model depends on the project’s goals, compliance strategy, and target audience.

- If you’re launching a quick, permissionless project and want global access, an ICO might work—though risky.

- For projects seeking legitimacy and regulatory alignment, especially those with asset backing, an STO is a safer bet.

- For maximum exposure, credibility, and convenience, especially for B2C crypto apps, an IEO offers the best of both worlds.

Which Fundraising Model is Best for Your Crypto Project?

Choosing between ICOs, STOs, and IEOs depends on your project’s stage, goals, and resources. Early-stage startups with innovative concepts but limited budgets may prefer ICOs for their low cost and global reach, despite the risks. Projects prioritizing investor protection and aiming to tokenize assets should opt for STOs, provided they can manage regulatory costs. IEOs are ideal for projects seeking a balance of trust, liquidity, and market access, especially if partnered with a reputable exchange.

Consider your timeline, regulatory appetite, and target audience—ICOs suit community-driven projects, STOs align with traditional finance, and IEOs offer a streamlined, exchange-backed approach. Thorough planning, including a robust whitepaper and community engagement, is critical regardless of the model.

Conclusion: Strategic Selection Is Key to Success

The crypto fundraising landscape has matured, and choosing the right model—ICO, STO, or IEO—can make or break your project. ICOs are fast but risky; STOs are regulated but complex; IEOs balance credibility with cost. Projects should consider legal frameworks, investor preferences, and long-term objectives before deciding. With increasing scrutiny in the crypto space, regulatory readiness, transparency, and utility should drive your decision—not just hype.

By aligning your project’s objectives—whether speed, security, or market reach—with the right model, you can maximize funding success.