How to Evaluate an ICO Project before Investing?

Here’s What’s Inside This Blog Post1 What is an ICO?2 Why Evaluate an ICO?2.1 History And Evolution3 Key Factors

Here’s What’s Inside This Blog Post

- 1 What is an ICO?

- 2 Why Evaluate an ICO?

- 3 Key Factors to Consider When Evaluating an ICO

- 3.1 1. Research the Team

- 3.2 2. Understanding The Whitepaper

- 3.3 3. Evaluate the Technology

- 3.4 4. Assess the Market Potential

- 3.5 Target Market

- 3.6 Competitive Landscape

- 3.7 5. Understand the Tokenomics

- 3.8 Token Distribution

- 3.9 Use Of Funds

- 3.10 6. Review the Roadmap & Milestones

- 3.11 7. Check for Legal Compliance

- 3.12 8. Evaluate Community and Marketing

- 3.13 9. Analyze the Financials

- 3.14 10. Identify Risks and Red Flags

- 3.15 11. Assessing The Business Model

- 3.16 12. Legal And Regulatory Compliance

- 4 Additional Tips for Evaluating ICOs

- 5 Frequently Asked Questions

- 6 Conclusion: A Smart Investor Always Researches First

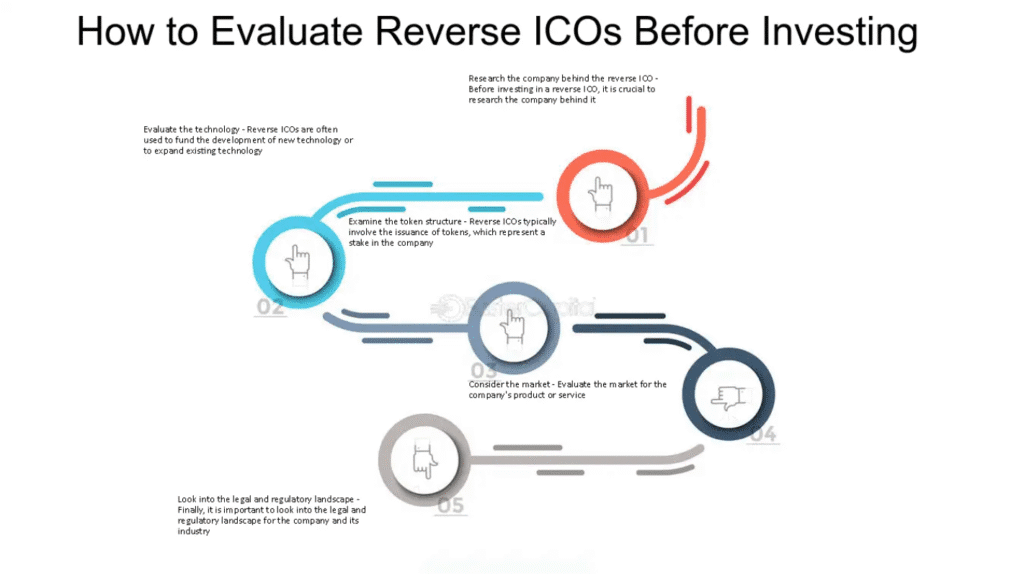

Investing in Initial Coin Offerings (ICOs) can be an exciting opportunity to get in early on groundbreaking blockchain projects. However, the crypto space is fraught with risks, and many ICOs have failed to deliver on their promises, leaving investors with worthless tokens. According to a study by TokenData, over 80% of ICOs launched between 2017 and 2018 failed to meet their goals or deliver value to investors. To protect your investment and make informed decisions, it’s crucial to thoroughly evaluate an ICO project before committing your funds. This comprehensive guide outlines the major key facts and points to consider when evaluating an ICO, ensuring you have the tools to make smarter investment choices.

Initial Coin Offerings (ICOs) have become a popular way for startups to raise funds. But not all ICOs are created equal. Some can be risky and lead to financial loss. Knowing how to evaluate an ICO project can save you from making costly mistakes.

Here’s a comprehensive guide on how to evaluate an ICO project before investing, based on proven research and key industry practices. We will cover key factors to consider before investing. By the end of this post, you will have a clear understanding of what to look for in an ICO project. So, let’s dive in and learn how to evaluate an ICO project before investing.

What is an ICO?

An Initial Coin Offering (ICO) is a fundraising method used by blockchain startups to raise capital. In an ICO, the project sells its native cryptocurrency tokens to investors in exchange for other cryptocurrencies (like Bitcoin or Ethereum) or sometimes fiat currency. These tokens may grant investors access to the project’s ecosystem, governance rights, or other utilities, depending on the project’s design. ICOs are often compared to Initial Public Offerings (IPOs) in traditional finance, but they are typically less regulated, which means investors must exercise extra caution, as highlighted by Investopedia.

Why Evaluate an ICO?

ICOs are high-risk investments. Unlike stocks or bonds, they are not backed by traditional financial systems, and many projects fail to deliver on their promises. The high failure rate underscores the importance of due diligence. By evaluating an ICO thoroughly, you can identify red flags, assess the project’s potential, and make more informed decisions. This guide covers the key factors to consider, from the team to the tokenomics, to help you navigate the complex world of ICOs.

History And Evolution

ICOs first gained traction around 2013. One of the earliest and most successful ICOs was Ethereum, which raised over $18 million in 2014. This set the stage for a new way of fundraising that has since evolved significantly.

Initially, ICOs were an unregulated space, leading to both incredible successes and spectacular failures. Over time, regulatory bodies across the globe began to take notice, introducing rules to protect investors. This evolution has made the ICO landscape safer but also more complex.

Today, ICOs are more structured and transparent, with whitepapers, roadmaps, and even legal frameworks. But the risk remains. Thorough research and due diligence are your best friends when navigating this volatile landscape.

Have you ever participated in an ICO? What was your experience like? Share in the comments below. Your insights could help others make better investment choices.

Key Factors to Consider When Evaluating an ICO

Below are the major factors to assess when evaluating an ICO project, each with detailed insights to guide your decision-making process.

1. Research the Team

The team behind the project is often the most critical factor in its success. A strong, experienced team with a track record of delivering results is more likely to execute their vision. According to Cryptopotato, researching the team’s background is essential.

What to Look For:

- Verify team members’ credentials on platforms like LinkedIn, GitHub, or professional networks. Examine the team’s track record. Have they successfully launched projects in the past? Look for any notable successes or failures. This can give you insight into their capabilities.

- Look for experience in blockchain, finance, or the specific industry the project targets.

- Check if the team has been involved in successful projects or previous ICOs, and assess their impact.

- Look for well-known advisors or partnerships with reputable entities, as these can add credibility.

- Be wary of anonymous teams or those with unverifiable credentials, as anonymity is a common red flag in scams.

Example: Projects like Ethereum gained credibility because their founder, Vitalik Buterin, was a well-known figure in the blockchain community with a proven track record.

How to Research:

- Search for team members’ names on Google and LinkedIn.

- Check their contributions on GitHub for technical expertise.

- Look for the project’s announcement thread on forums like BitcoinTalk to gauge community trust.

2. Understanding The Whitepaper

Evaluating an ICO project is crucial before investing. The whitepaper is the project’s blueprint. It explains the vision, technology, and plans. Understanding the whitepaper helps make informed decisions.

The whitepaper is detailed. It covers many aspects of the project. Let’s break down the key components. This will help you grasp the essentials.

Key Components

The whitepaper should include a clear problem statement. This explains what issue the project aims to solve. Look for detailed solutions. The technology behind the project should be well-described.

Team information is vital. Check the experience and qualifications of the team members. A strong team indicates potential success.

Tokenomics is another key component. Understand the token distribution, usage, and value proposition. This affects your investment directly.

Roadmap outlines the project’s future plans. It should be realistic and achievable. Timelines for development and milestones are important.

Red Flags To Watch

- Watch for vague or unrealistic promises. If the whitepaper lacks detail, be cautious. Overly ambitious goals can be a sign of trouble.

- Check for inconsistencies in the whitepaper. If information contradicts itself, it may indicate poor planning or dishonesty.

- Be wary of anonymous teams. Transparency is crucial. Without it, trust is hard to establish.

Look for inflated token supply. This can lead to devaluation. Ensure the tokenomics are sound and reasonable.

3. Evaluate the Technology

The technology underpinning the ICO project is another crucial factor. A project must solve a real problem with innovative technology to have long-term potential. As noted by Solulab, a detailed whitepaper is a key indicator of a project’s technical credibility. . Two key areas to focus on are the underlying technology and the development roadmap.

Underlying Technology

The underlying technology is the backbone of any ICO project. It includes the blockchain platform and any unique features. Check if the technology is scalable. Ensure it can handle growth and user demand. Look for security features. They protect user data and transactions. Verify the technology’s transparency. Open-source projects allow public scrutiny. This builds trust. Strong technology is essential for long-term success.

Development Roadmap

The development roadmap outlines the project’s future plans. It shows the stages of development and expected timelines. A clear roadmap is a good sign. It indicates the team has a structured plan. Check for detailed milestones. These show the team’s progress and commitment. Make sure the roadmap is realistic. Unrealistic timelines can be a red flag. A solid roadmap ensures the project stays on track. It helps measure the project’s growth and success.

What to Look For:

- Read the whitepaper carefully. It should clearly explain the problem the project solves, the technology used, and how it works.

- Check if the technology is innovative or merely a copy of existing solutions.

- Look for evidence of working prototypes, beta versions, or open-source code on platforms like GitHub.

- Ensure the project addresses a real-world problem with a feasible technical approach.

Example: Filecoin, a decentralized storage solution, gained traction because its technology addressed the real-world problem of centralized cloud storage with a blockchain-based alternative.

Red Flags:

- Vague or overly technical whitepapers that lack clarity.

- No evidence of a working product or prototype.

- Claims of revolutionary technology without supporting details.

4. Assess the Market Potential

Even the best technology won’t succeed without a market for it. Evaluating the market potential involves understanding the demand for the project’s solution and its competitive landscape, as emphasized by Investopedia.

When evaluating an ICO project before investing, conducting a thorough market analysis is crucial. Market analysis helps you understand the target market and the competitive landscape, two critical components that can determine the potential success of the project. Let’s break it down into more specific aspects.

Target Market

Identifying the target market is your first step. Who are the potential users or customers of the ICO project?

Understand their needs, preferences, and pain points. A project targeting a well-defined market segment is more likely to succeed. For example, if an ICO project aims to revolutionize digital payments in emerging markets, it should clearly outline why these regions are in need of such solutions.

Is there a genuine demand for what the ICO project is offering? Gauge the market size and growth potential. A small but growing market can sometimes be more promising than a saturated one. Think about how the project plans to attract and retain users.

Competitive Landscape

Analyzing the competitive landscape helps you understand who else is in the game. Are there other projects offering similar solutions? If yes, what sets this ICO project apart?

List out direct and indirect competitors. Look at their strengths and weaknesses. Is the ICO project offering a unique value proposition that addresses a gap in the market?

Consider how the project plans to compete. Does it have a clear strategy for differentiating itself? Maybe it offers better technology, lower costs, or enhanced user experience. A personal experience here could be valuable; I once invested in a project that promised a unique feature only to find out a competitor was already doing it better.

Evaluate the project’s competitive advantage. Is it sustainable in the long run? Companies often claim to have a cutting-edge product, but without solid competitive advantages, they may struggle to maintain their position.

By understanding the target market and competitive landscape, you can make a more informed decision about whether an ICO project is worth your investment. How do you evaluate these aspects when considering an investment?

What to Look For:

- Analyze the target market size and growth potential.

- Identify competitors and understand how the project differentiates itself.

- Check if there’s a genuine demand for the product or service.

- Look for partnerships or integrations that validate market fit.

Example: Binance Smart Chain succeeded because it offered a faster, cheaper alternative to Ethereum at a time when scalability was a major issue in the crypto market.

How to Assess:

- Research the industry the project targets (e.g., DeFi, gaming, supply chain).

- Compare the project to competitors using platforms like CoinMarketCap or CoinGecko.

- Check for market validation through partnerships or pilot programs.

5. Understand the Tokenomics

Tokenomics (token economics) determines the value and utility of the tokens you’re buying. A well-designed token economy should incentivize users and contributors while maintaining scarcity and value, as discussed in Solulab.

Token Distribution

Token distribution is vital. It tells you how tokens are allocated among different stakeholders. Look at the percentage of tokens reserved for the team, advisors, and early investors. Excessive allocation to these groups may indicate centralization or potential for price manipulation.

Check if a significant portion is allocated to public sales. It indicates a fair opportunity for small investors. Also, watch out for vesting periods. A well-defined vesting schedule ensures that team members and advisors remain committed to the project’s long-term success.

Use Of Funds

How the project plans to use the raised funds is another critical factor. Examine the budget allocation. A transparent breakdown of fund usage shows that the team has a clear plan.

Look for detailed categories such as development, marketing, legal, and operational costs. A balanced allocation indicates a well-rounded approach. Pay close attention to the amount reserved for development. More funds for development often point to a focus on creating a strong product.

What to Look For:

- Total token supply and how it’s distributed (e.g., to the team, advisors, investors, etc.).

- The purpose of the token within the ecosystem (e.g., utility, governance, or speculative).

- Vesting periods for team tokens to prevent early dumping.

- Mechanisms for token scarcity or deflation, such as burning or staking.

Example: Tezos’ tokenomics include a governance model where token holders can vote on upgrades, adding long-term value to the token.

Red Flags:

- Excessive token allocation to the team or advisors.

- No clear use case for the token within the ecosystem.

- Lack of transparency in token distribution.

Ask yourself: Does the use of funds align with the project’s goals? If not, it might be a red flag. Always ensure that the fund allocation supports the project’s roadmap and long-term vision.

6. Review the Roadmap & Milestones

A credible ICO will have a detailed, time-bound roadmap with clearly defined deliverables. Check if the project has already achieved early development goals like MVPs (Minimum Viable Products), audits, partnerships, or alpha/beta versions. Unrealistic or overly ambitious roadmaps with no working product should be approached cautiously. Real progress shows real intent and competence.

What to Look For:

- Specific, achievable milestones with clear timelines (e.g., whitepaper completion, beta testing, mainnet launch).

- Updates on completed milestones to ensure the team is delivering.

- Be skeptical of overly ambitious or vague roadmaps.

Example: Polkadot’s roadmap included clear phases for development, from parachain auctions to interoperability solutions, which helped build investor confidence.

Red Flags:

- Roadmaps with no specific dates or deliverables.

- Repeated delays in meeting milestones.

- Unrealistic timelines for complex technical goals.

7. Check for Legal Compliance

Legal compliance is a critical but often overlooked aspect of ICO evaluation. Regulatory issues can jeopardize a project’s long-term viability, as noted by Investopedia.

What to Look For:

- Ensure the project complies with laws in its jurisdiction and target markets.

- Check if the project has legal advisors or has undergone legal reviews.

- Look for transparency about regulatory compliance in the whitepaper or website.

Example: Many ICOs in 2017-2018 faced legal challenges due to non-compliance, while newer projects like those on regulated platforms (e.g., Binance Launchpad) have clearer compliance frameworks.

Red Flags:

- Operating in regulatory gray areas without legal counsel.

- Lack of information about compliance or jurisdiction.

- Projects that avoid discussing regulatory risks.

8. Evaluate Community and Marketing

A strong community can drive adoption and support the project’s growth. Effective marketing strategies can also attract investors and users, as discussed in Cryptopotato. Let’s dive into these aspects to help you make a well-informed decision.

Community Engagement

Community engagement is a critical factor in assessing an ICO project. A thriving, engaged community can signal strong support for the project. Are people actively discussing the project on forums and social media platforms? Check platforms like Reddit and Telegram to gauge community activity.

Look for transparency from the project team. Are they addressing questions and concerns from the community? Regular updates and open communication can build trust and show the team’s commitment to the project.

Consider your own experience—have you ever been part of an enthusiastic community that drove a project’s success? This can be a good benchmark to compare against the ICO project’s community.

Social Media Presence

A project’s social media presence can provide insights into its marketing strategy and reach. Check platforms like Twitter, Facebook, and LinkedIn. Are they posting regularly and engaging with their followers? A consistent and active presence can indicate a well-thought-out communication strategy.

Evaluate the quality of their content. Are their posts informative and relevant? Do they provide updates about the project’s progress? Quality content can attract and retain followers, which is crucial for any ICO project.

Think about your favorite brands on social media—what makes their presence appealing? Use this as a guide to evaluate the ICO project’s social media efforts.

What to Look For:

- Active social media channels (e.g., X, Telegram, Discord).

- Engaged forums or subreddits, such as those on BitcoinTalk.

- Partnerships with influencers or reputable organizations.

- Regular updates and transparent communication with the community.

Example: Dogecoin’s community-driven growth showed how a strong following can impact a project’s success, though it’s not always tied to fundamentals.

Red Flags:

- Projects that rely solely on hype without substance.

- Inactive or unresponsive community channels.

- Aggressive marketing with unrealistic promises.

By focusing on community engagement and social media presence, you can gain a clearer picture of an ICO project’s potential. Ask yourself: Does the project have a supportive and active community? Is their social media presence strong and consistent? These insights can guide your investment decisions.

9. Analyze the Financials

Understanding how funds will be used ensures transparency and reduces the risk of mismanagement. A clear financial plan is a sign of a well-thought-out project, as noted by Investopedia.

What to Look For:

- A clear budget outlining how funds will be allocated (e.g., development, marketing, operations).

- Reasonable valuation and funding goals.

- Transparency about how funds will be managed and audited.

Example: Ripple (XRP) raised funds with clear plans to develop its payment network, contributing to its long-term success.

Red Flags:

- Unclear or missing financial plans.

- Unrealistically high valuations or funding goals.

- Lack of transparency about fund allocation.

10. Identify Risks and Red Flags

Every investment carries risks, but ICOs are particularly volatile due to their unregulated nature. Identifying red flags can help you avoid scams or poorly executed projects, as warned by Medium. By focusing on risk management, you can make better investment decisions.

Identifying Risks

First, identify potential risks in the ICO project. Look at the team behind the project. Check their experience and past projects. A weak team can be a red flag. Next, evaluate the project’s whitepaper. Ensure it is clear and comprehensive. Vague or poorly written whitepapers can indicate a lack of planning.

Examine the project’s technology. Does it have a unique value proposition? Is the technology feasible? Assess the market conditions. Understand the demand for the project’s solution. Consider regulatory risks. Changes in laws can impact the project’s success. Lastly, look at the token distribution. Uneven distribution can lead to price manipulation.

Mitigation Strategies

Once you identify risks, develop strategies to mitigate them. Diversify your investments. Do not put all your money into one ICO. Research thoroughly. Verify the project’s claims and team credentials. Use independent sources. Stay updated on regulatory changes. This helps you adapt to new laws.

Consider using escrow services. They hold funds until the project meets specific milestones. This reduces the risk of losing your investment. Join online communities. Engage with other investors and experts. They can provide valuable insights and warnings. Always have an exit strategy. Know when to sell your tokens to minimize losses.

What to Look For:

- Anonymous or unverifiable teams.

- Lack of transparency (e.g., no regular updates or unclear communication).

- Unrealistic promises or overly optimistic projections.

- No clear use case for the token.

- Pressure to invest quickly, a common tactic in scams.

Example: The BitConnect ICO was a notorious scam, promising unrealistic returns and lacking transparency, which led to its collapse in 2018.

Table of Common Red Flags:

| Red Flag | Why It’s a Concern |

|---|---|

| Anonymous Team | Lack of accountability increases the risk of scams. |

| Vague Whitepaper | Indicates a lack of clarity or seriousness about the project’s goals. |

| Unrealistic Promises | Overhyped returns often signal a scam or unsustainable project. |

| No Token Utility | Tokens without a clear purpose may lack long-term value. |

| High Team Token Allocation | Suggests potential for early dumping, reducing investor value. |

| Lack of Community Engagement | Weak community support may indicate low adoption potential. |

11. Assessing The Business Model

Evaluate an ICO project by understanding its business model. Check the problem it solves and its market potential. Ensure the team has relevant experience and a clear roadmap.

Investing in an ICO (Initial Coin Offering) project can be highly rewarding, but it also comes with its fair share of risks. One of the most crucial aspects to look at before committing your funds is the project’s business model. Understanding how the project plans to generate revenue and sustain itself in the long run can provide invaluable insights into its viability.

Revenue Streams

Knowing how an ICO project plans to make money is essential. Is the revenue model clear and straightforward?

For example, a project might generate income through transaction fees, premium memberships, or partnerships with other businesses.

Take a moment to think about whether these revenue streams are realistic and scalable. If the project relies on a single source of income, it might be more vulnerable to market changes.

Sustainability

Sustainability is another key factor. Ask yourself whether the project can maintain its revenue streams over time.

A business model that looks great on paper might not be practical in the long run. For instance, if the project relies heavily on user growth, what happens if new users stop coming in?

I once invested in an ICO that promised high returns through user fees. Everything looked good until user growth plateaued, and the project struggled to stay afloat. This experience taught me to consider long-term sustainability seriously.

Is there a plan for market fluctuations or downturns? A robust business model should include strategies for adapting to different economic conditions.

Evaluating these factors will help you make a more informed investment decision. Remember, a solid business model is a cornerstone of any successful ICO project.

12. Legal And Regulatory Compliance

When evaluating an ICO project, one of the most critical aspects to consider is legal and regulatory compliance. This ensures that the project operates within the bounds of the law and reduces the risk of potential issues down the road. Understanding the project’s legal framework can save you from headaches and financial losses.

Jurisdiction

The location where the ICO is registered plays a significant role in its compliance with legal standards. Different countries have varying regulations regarding ICOs.

For instance, ICOs registered in countries with stringent regulations like the United States or the European Union might offer more security. These jurisdictions have established frameworks that protect investors.

On the other hand, ICOs registered in countries with lax regulations might pose higher risks. Ensure you know where the project is legally based and research that country’s laws on ICOs.

Regulatory Risks

Investing in ICOs comes with regulatory risks. Governments can change laws, impacting how ICOs are managed. This could affect your investment.

Consider how the project plans to navigate these risks. Look for ICOs that have legal advisors or partnerships with regulatory bodies. This shows they are proactive about compliance.

Ask yourself: Is the project prepared for potential regulatory changes? A well-prepared project can adapt and continue to thrive despite legal challenges.

Remember, thorough research on legal and regulatory compliance can mean the difference between a successful investment and a financial disaster. Always prioritize this aspect when evaluating any ICO project.

Additional Tips for Evaluating ICOs

- Use ICO Rating Platforms: Websites like ICObench, CoinGecko, or CryptoSlate provide ratings and reviews based on community feedback and expert analysis.

- Check for Audits: Look for smart contract audits from reputable firms like CertiK or Quantstamp to ensure the project’s code is secure.

- Monitor Social Media and Forums: Platforms like BitcoinTalk, Reddit, and X can provide insights into community sentiment and potential red flags.

- Be Cautious of Hype: Don’t invest based solely on marketing campaigns or celebrity endorsements. Always conduct your own research.

- Security and Smart Contract Audit: Security is non-negotiable in crypto. Look for projects that have undergone independent smart contract audits by reputable firms. Audit reports help identify vulnerabilities before the token is released into the wild. If a project hasn’t been audited—or refuses to provide results—it’s a red flag. Also, review GitHub repositories for open-source development activity if available.

Frequently Asked Questions

What Are Some Of The Key Factors Investors Typically Evaluate When Considering An ICO Project?

Investors evaluate the ICO team’s experience, project whitepaper, technology, market potential, tokenomics, and community support. They assess the project’s roadmap, partnerships, and legal compliance to gauge credibility and potential returns.

How Do You Analyze Cryptocurrency Before Investing?

Analyze cryptocurrency by researching the project’s whitepaper, team, and technology. Check market trends, community support, and historical performance. Evaluate security measures and regulatory compliance.

How To Assess A Crypto Project?

Assess a crypto project by checking its whitepaper, team, technology, community, and market potential. Analyze partnerships, use cases, and tokenomics.

How Do I Run A Successful ICO?

To run a successful ICO, build a strong team, create a clear whitepaper, ensure legal compliance, promote effectively, and engage with your community.

Conclusion: A Smart Investor Always Researches First

ICOs may promise high returns, but informed investing is your best defense against scams and poorly planned projects. By carefully evaluating the whitepaper, team, tokenomics, community presence, and legal aspects, you can greatly increase your chances of investing in a legitimate and successful ICO. Always remember the golden rule of crypto investing: “Do Your Own Research (DYOR)” before risking your capital.

Verify partnerships with reputable companies. Always prioritize security measures. By following these steps, you can make informed investment decisions. Stay vigilant and invest wisely.